RNF Racing considering relationship with Yamaha amid uncertain MotoGP future

Paddock talk ahead of the French MotoGP at Le Mans suggests RNF Racing Yamaha is considering its future for 2023 MotoGP season

While Suzuki has commanded the lion’s share of the publicity ahead of the French MotoGP following the revelation it is planning to exit MotoGP at the end of the season, rumours circulating in Le Mans suggest it too is considering its options for the future.

Indeed, paddock sources have indicated that RNF Racing Yamaha is assessing the possibility of switching brands or potentially even exiting the series altogether as it struggles to find the form that had it challenging for wins and the title just two seasons ago.

One of MotoGP’s newest operations, the Malaysian-flagged team - headed by Razlan Razali - debuted in 2019 with substantial backing from state oil giants Petronas after succeeding KTM-bound Tech 3 Racing as Yamaha’s associated satellite effort.

Proving competitive from the off, it is renowned as the team that gave Fabio Quartararo his shot in MotoGP prior to his romp towards the 2021 MotoGP title on the factory Yamaha, while Franco Morbidelli swept to three victories en route to the runners-up spot in a title-challenging 2020 campaign.

However, after the team’s form slid significantly in 2021 - scoring just a single podium as it suffered with ageing machinery during a technical regulation freeze - it was then forced to scale down its efforts and rebrand to RNF Racing for 2022 in the wake of Petronas’ departure as title sponsor and financial backer.

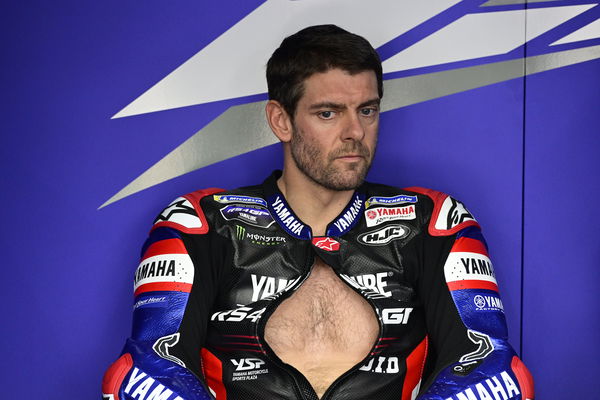

Despite hiring experienced 14-time race winner Andrea Dovizioso - alongside rookie Darryn Binder - RNF Yamaha has struggled to make much of an impression during the initial rounds of the 2022 season, sparking talk of yet another overhaul for 2023.

Speaking to GPOne.com, Razali emphasised he wants to return the outfit to its original objective of being an associated 'junior team' with one of the manufacturers to foster fresh talent, a strategy that it veered away from in 2021 with Yamaha's insistence that it take on Valentino Rossi, before accepting Dovizioso in return for an on-spec M1 and to attract backers.

"We have already shown that we can do it, our former riders are in the works team. This is the way forward, I don't like being called a satellite or independent team. We are a junior team, we have young riders grow for the factory.

However, though Razali insists the relationship with Yamaha is 'good' he says he's willing to defect to another manufacturer if it allowed RNF to adopt closer relationship with the factory.

"There is the possibility of changing manufacturers, but it is something difficult to do. I would like to have a relationship with Yamaha like the one Ponacharal had for more than 20 years, or of Cecchinelli with Honda. In this way you run together with the factory, you win and lose together.

The rise and slide of RNF Yamaha in MotoGP

Prior to Suzuki’s bombshell, any talk of RNF Yamaha’s wavering commitment to Yamaha or MotoGP may not have come as such a massive shock.

It has been a sobering 18 months for a team that showed up the factory Yamaha effort for much of 2019 and 2020, but the departure of Petronas as its key backer has had a noticeable impact on what is a much smaller and more cost-conscious RNF Racing.

Indeed, despite Razali's comments, RNF’s relationship with Yamaha has certainly distanced since 2020, while it is telling it only penned a single-year deal to run satellite machinery for 2022, indicating a ‘wait and see’ approach for both parties.

Beyond the tighter belts in the cash department, at the heart of RNF’s frustrations is a Yamaha package that - while effective in championship leader Quartararo’s hands - has become something of an enigma for everyone else, with even Morbidelli proving one of the season’s unexpected disappointments, while Dovizioso for all of his experience has cut a defeated figure in the wake of lacklustre results on his return to the series.

The option of changing manufacturer would be an extreme one, not least because there isn't a clear avenue for it to pursue. Indeed, Suzuki might have been an option prior to its announcement and while Aprilia looks best placed to fill that vacancy with a satellite effort, it is understood Moto3 outfit Leopard Racing are favourites to take that project on.

With Ducati likely maxxed out with its four teams and any potential third team from KTM likely to be an Aspar-run GASGAS effort, it would leave RNF Racing with only Honda to canvas. However, even if it became a third string effort, it is unlikely to receive greater support than LCR or any more than it currently has with Yamaha.

Toprak Razgatlioglu key to smoothing Yamaha MotoGP relations?

However, RNF Racing’s hopes could be boosted by Yamaha’s evident desire to strengthen its talent pool, with Lin Jarvis telling Motorsport.com that it is keen to get its WorldSBK champion Toprak Razgatlioglu on what would need to be a satellite Yamaha in 2023, while it is also known to be interested in luring Raul Fernandez from KTM.

Though Razgatlioglu - or rather, his manager Kenan Sofuoglu - hasn’t been enamoured by the idea of accepting a satellite Yamaha deal rather than a factory one, the rider market shake-up prompted by Suzuki’s exit means the Turk has slid down the order of priority for alternative works offers. That said, it means Razgatlioglu could remain in WorldSBK as a result.

With this in mind, depending on Yamaha’s determination to get Razgatlioglu on a MotoGP bike in 2023, it might lead to it investing back in RNF to ensure pseudo-factory support in return for his commitment.

Moreover, Dorna will be very keen not to lose two teams at the end of the season and while it is unlikely to get Suzuki to reverse its decision, it might have more leverage in ensuring RNF stays on board for now.

Alternatively, Yamaha could use this as an opportunity to canvas options for an entirely different team coming in to run its satellite effort even if it has indicated it would prefer to focus fully on ensuring Quartararo retains its title rather than divert resources towards negotiating new deals.